“How much can the economy really heat up?”

“How much can the economy really heat up?”

NASA Virtual Solar Observatory Image

Yet another part of the long-term Republican plan has emerged with North Carolina banning excessive sea level rise . Wondered about the proliferation of super yachts? Obviously the mega-rich who prefer coastal living have made their coasts personal and portable. No more unseemly beach public access fights like those poor Malibu multi-millionaires….Just “get the ____off my boat!” Banning sea-level rise is only part of a deeper plot, the ban widening the spread on real-estate speculation on post-global-warming coastal properties. What is more sinister is the trend to global cooking (as opposed to global warming) where the plot leaders have engaged a large segment of the economics profession to obscure the fact that their plans for limitless growth to solve all economic problems will inevitably cook your grandkids. This should lead to passing laws against the first and second laws of thermodynamics. Rumor has it that Rand Paul is ready to propose such legislation.

They are hiding the fact that heat is work and work is heat (first law of thermodynamics) as explained in this British song which was inspired by C.P. Snow and his ‘two cultures,’ and it takes lots of heat to produce work. The effects of all the heat given off by the work necessary to sustain this exponential growth have been neatly calculated by UCSD physicist Tom Murphy who estimates that if we continue to grow at this rate it would take the energy output of the entire galaxy to meet our energy needs in about the time than it took to go from the Roman Empire to the present, as shown in this graphic (shown below) from his website.

In a little over 200 years, based on projected energy requirements, we’ll need the total solar energy falling on the earth’s landmass to sustain growth, and the exponential curve is daunting. The surface of the earth will be an exceedingly hot place. Looking at the science, the plot must have more sinister intent: it stretches credulity to believe that Paul Ryan and the rest of the right-wing neo-booboisie are so ignorant of science and math that they don’t see the results of their actions. On second thought, maybe we’re giving Ryan too much credit, having seen the math in his budget. So what’s their real game? To find the answer, we turn to Jonathan Swift, of Gulliver’s Travels fame, and his 1729 essay on his Modest Solution for Solving Poverty and Population Issues .

Swift notes, “I have been assured, by a knowing American of my acquaintance in London, that a young, healthy child, well nursed, is at a year old a most delicious, nourishing, and wholesome food, whether stewed, roasted, baked, or boiled…” and goes on to demonstrate the efficacy of allowing the poor to raise a certain percentage of their children as a way to eliminate starvation and surplus population in Ireland without excessive dependency on taxation and government support. Here, the full brilliance of the current plan is revealed. Global warming will eliminate a large percentage of the population, and the plan will allow this rapid reduction without, as Swift pointed out, any real hardship on the poverty-stricken mothers of the edible children, probably to be sold pre-cooked. (It is not likely that the American in question was W.C. Fields, though he did say his liking for children depended on how they were cooked.)

Cantor’s dour pronouncements on the necessity of taxing the poor will apparently be replaced by the new, post-Citizen’s United motto of the Republican Party which will be, “Serving our fellow man since 1729,” to honor the date of Swift’s proposal, but many recent members of Congress apparently want to make it “since the 2010 midterms”. Thus, the .01 percent will soon be able to retreat from the now- devastated sources of their wealth to their Caribbean-like coastal resorts on the beaches of Antarctica, located under huge climate-controlled domes in case they got the science a little wrong. The rest of the world’s greatly diminished population will live in sweltering heat, in abandoned mines or in the ruins of subterranean parking garages, thus greatly reducing demands on the world’s resources while they scavenge from the ruined excess of the 21st century to maintain the lifestyles of the .01%. Thus humanity will be preserved, allowing time for the remaining elite to evolve to a higher plane of awareness, where society and governments exists for the benefit of all.

Notes:

I admit that the title of this column is blatantly unfair–a significant number of Democrats display similar dangerously short-sighted illogical tendencies. However I think that what we are doing to our young and the planet we will leave them is far more inequitable and completely immoral. The point was driven home to me in a discussion with an MBA student participant in the Dominican University Green MBA program to develop a simplified ‘policy flight simulator’ to study resource and ecological impacts on economic performance. He was greatly discouraged when he came to the emotional realization that all production of tradable goods of value inevitably requires the consumption of resources, and, to the extent that they are not renewable (e.g. petroleum and the products of the extractive sector of the economy) will eventually run out and we’re using them up a lot faster than people think. He wanted to know what will happen to our society when the industries and ecological services that support so much of modern life cease to be available.

Robbing our young of hope for the future is the worst sin of our current situation. My answer was that I looked to the future with great concern but guarded optimism, a position shared by many in the scientific community. I pointed out that essentially no modern technology was involved in the evolution of human intelligence, a process powered largely by solar energy. The development of agriculture (more solar energy) allowed us to progress to the point that we could develop our own extractive energy such as coal, and later oil, fueling the Industrial Revolution. The fact that we have spent resources so profligately has at least helped us to get to the point where we can begin, with the advances in the biological sciences, look to nature’s solar-powered biological systems as a starting point to provide an ever increasing percentage of humanities needs without depending upon extractive technologies.

For example, the spider’s web can teach us much about bioengineering materials: the spider uses six nozzles to spin its web with unique structural properties for each web component, producing materials far exceeding many of the properties of steel. Molecular computing, including the use of DNA, is in its infant stages, promising more power for certain critical problems than even the fastest current supercomputer. Given sufficient intellectual energy, education and research, dependence on the extractive technologies will plummet, and that’s where the real economic future lies. Yet all of modern science and improvements in technology and efficiency will not allow us to follow a system of political economy based on exponential growth that breaks physical laws. Change, probably much sooner than we think, is inevitable.

Life on earth, as opposed to Mars or Venus, owes its existence to what is sometimes called the Goldilocks Zone. Mars is too cold, Venus is too hot, but Earth is just right for human life to have gained a toehold (this peculiar anthropocentric point is worth a whole essay in itself, considering what we now know about microbial life, especially the extremophiles). It is remarkable that Earth has maintained this temperature range, and lead to Margulis and Lovelock’s work on the Gaia principal of the earth as a self-regulating system. The thermodynamics of exponential growth, if even possible within the constraints of natural resources, would soon take us out of both any possible Gaian control mechanism and the Goldilocks zone. The assumption that we can use such growth as the basis of our economic future is clearly unworkable.

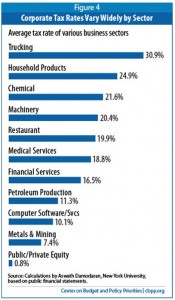

There are real barriers to change, principally our current governance which is in thrall to the extractive resource industry and financial sector’s army of lobbyists. Adam Smith put it well when he noted that the extraction of profits is often at the expense of economic health; “Our merchants and master-manufacturers complain much of the bad effects of high wages in raising the price, thereby lessening the sale of their goods both at home and abroad. They say nothing concerning the bad effects of high profits. They are silent with regard to the pernicious effects of their own gains. They complain only of those of other people.” Wealth of Nations Book I, Chapter IX. Incidentally, it is oxymoronic that Greenspan has apparently been know to quote Adam Smith and Ayn Rand in the same speech. Ayn Rand’s dogma has nothing to do with Adam Smith’s logic, and indeed, is for the most part completely contradicted by it.

Much as one might wish it so, there is no ‘Kumbaya’ link between those who are ruled by dogma and those who wish to be governed with a logical philosophy. Global cooking/ global warming or change in attitude; we don’t have much time to choose. The future is fraught with possibilities, provided we don’t lose our cool.